In Microsoft Excel, you can create custom templates to save time filling and calculating often used files, such as invoices. Input your data, and the template will automatically calculate the required results. In this article, we provide you with a free Tax Invoice template that can be adjusted to your needs, and an explanation of the different elements in the template.

A tax invoice is an enumerated list of charges for respective products sold and/or services rendered, along with the indirect tax payment for each product and service. A tax invoice must incorporate a description of the products or services, amounts, date of shipment, method of transportation, and costs. It also contains the entire amount and any included taxes.

The primary purpose of tax invoices, besides being a formal request for payment from a customer, is complying with a country’s taxation formalities. Taxpayers submit tax invoices to applicable authorities at the end of every financial year as substantiation for their tax submissions. For the government, tax invoices are essential as they control tax evasion. In addition to incorporating the relevant attributes on the invoices, a company or shop must issue their tax invoices in good time. For products, this is ideally when the products are delivered to customers. For services, the government charges tax invoices within thirty days after providing the services. Banks and other monetary organizations usually issue tax invoices within forty-five days.

Our invoice contains the company details in the left corner. Your invoice should always contain the name of your company or shop. The company address, phone, email, and website are also included here, as is standard for Tax Invoices.

You can also add your logo.

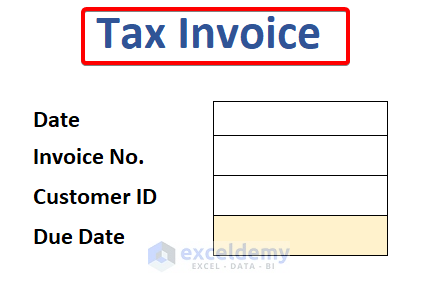

On the right-hand side, the Tax Invoice details are added. The term “Tax Invoice” should always be clearly visible on a Tax Invoice.

A Tax Invoice should contain Invoice No, Customer ID, the Invoice Date, and the Due Date for settlement.

The Biller is the Customer to whom the Invoice is issued. Your invoice should include customer information including Name, Company, Address, Phone, and Email.

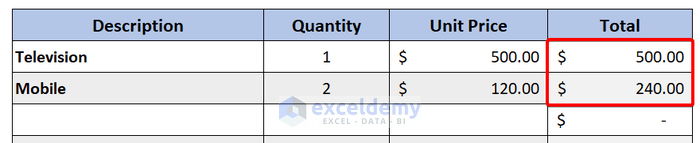

This is the list of items billed in the Invoice. For each item, our template includes the product/service’s Description, Quantity, Unit Price, and Total Amount.

Total Amount for each item is calculated as follows:

Total = Quantity * Unit Price

Similar Readings

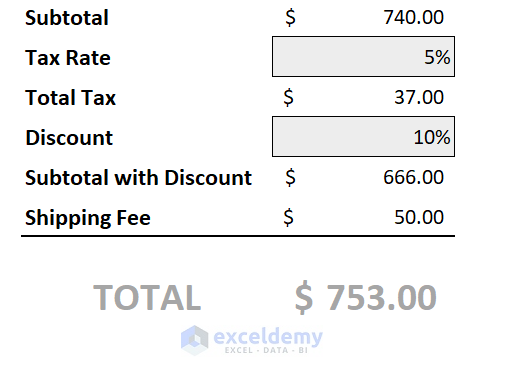

Total billing details, including Tax, Discounts and/or Shipping Fees are derived here.

Using the data entered above, the total bill will be:

The Subtotal is the sum of the Total Amounts for each line item.

We’ve used a tax rate of 5% in this example.

So the Total Tax on the subtotal is:

Total Tax = Subtotal * Tax RateLet’s assume a Discount of 10% has been granted.

Subtotal is now:

Subtotal with Discount = Previous Subtotal – (Previous Subtotal * Discount)Let’s add a shipping fee of $50.

Total amount due is now:

Total Amount = Subtotal with Discount + Total Tax + Shipping FeeFinally, in our Template you can add any additional remarks and signatures as desired. These remarks may include some conditions or rules of your company applicable to the Invoice or settling thereof.

For convenience to the Customer, we have included a section for Queries in the template.

Signatures of both supplier and customer can also be added to the Invoice (confirming that both parties have received and accepted the Invoice)

✎ Our tax invoice format includes the necessary formulas. Simply add your data and the Subtotals and Totals are automatically calculated.

✎ Your Tax Invoice should always contain the customer’s ID and Invoice No.

A.N.M. Mohaimen Shanto, a B.Sc. in Computer Science and Engineering from Daffodil International University, boasts two years of experience as a Project Manager at Exceldemy. He authored 90+ articles and led teams as a Team Leader, meticulously reviewing over a thousand articles. Currently, he focuses on enhancing article quality. His passion lies in Excel VBA, Data Science, and SEO, where he enjoys simplifying complex ideas to facilitate learning and growth. His journey mirrors Exceldemy's dedication to excellence and. Read Full Bio